Figure 1

At the dawn of the 21st Century, we face many critical challenges to sustaining our prosperity and our democracy. None, however, is more essential than ensuring our children get the best educational foundation we can provide for a productive lifetime of learning, achievement, and citizenship. Without question, an essential ingredient to our national well-being and New York's economic future must be strengthening the educational tools available to every New York child, as early in life as possible.

There is too much at stake to allow any of New York's children to fall through the cracks of our educational system. Our schools must not only meet, but exceed, their highest expectations by furnishing every child with the skills he or she needs to reach their potential. To achieve this goal, we must endeavor to provide every student with a classroom that fosters learning, a classroom that challenges, inspires, and draws out their best talents.

Four years ago, we embarked upon a mission to make New York State's public education system the strongest in the nation. To this end, the Assembly created the Learning Achieving Developing by Directing Education Resources (LADDER) program: a comprehensive, multi-year education initiative to secure a brighter future for all of our children. The LADDER program targets significant educational and financial support for children throughout the State by reducing class size, repairing and constructing school buildings, providing incentives for full day kindergarten, strengthening professional development, providing resources for up-to-date instructional materials and educational technology and establishing a Universal Pre-kindergarten program; these programs are all geared to provide children with a firm foundation upon which to base their continued achievements.

The Executive proposal for the 2001-02 once again turns its back on our children and our schools. As the schools strive to increase the achievement of their students, meet the new Regents higher learning standards, and improve their school environment, resources become essential. The Executive proposal represents a $1.129 billion cut in total State support for education that would have been generated under current law (see Figure 1). The budget provides $382 million or 2.79 percent more than last year in General Support for Public Schools; this represents a $1.078 billion cut in General Support for Public Schools that school districts would have received under present law provisions. The remainder of the total cut of $1.129 billion is from the Executive's elimination of $51.3 million in grants that are outside General Support for Public Schools (see Table 1). The amounts of these cuts are calculated on a school year basis.

Table 1

MAJOR EDUCATION CUTS

($ in millions)

|

Present Law

|

Executive

|

Difference

|

|

| Flex Aid Components |

$9,975.2

|

$9,828.5

|

(146.7)

|

| Building Aid |

1,659.1

|

1,345.2

|

(313.9)

|

| BOCES |

482.7

|

455.3

|

(27.4)

|

|

LADDER: |

|

225 140 0 15 0 258.5 30.2 0 |

(660)

(275) (85) (80) (76) (25) (84.2) (25) (10) |

| TEACHERS: Teacher Support Aid Mentor Teacher Intern Professional Development Grants Teacher Centers National Board |

67.48 5 10 30 1 |

15 0 0 0 0 |

(98.48)

(52.48) (5) (10) (30) (1) |

| Bilingual Education |

11.2

|

0

|

(11.2)

|

| Small Cities Aid |

81.88

|

69.31

|

(12.57)

|

Continuing the Assembly LADDER Program

The 2000-2001 school year marked the third year of implementation for the Assembly's four-year phase in of the LADDER program that is primarily designed to improve the quality of early childhood education. This innovative initiative provides a comprehensive approach to improving the educational system of the State which will culminate in an additional $1.3 billion in State support for education by 2001-02.

Certainly, the flagship initiative of LADDER is the Universal Pre-kindergarten program. Many questioned the feasibility of attempting to provide Pre-kindergarten services to all four-year olds in New York State in just four short years. But the Universal Pre-kindergarten program has defied the odds. In 2000-01, there were 52,000 four year olds served by the Universal Pre-kindergarten program; this represents 88 percent of the eligible children to be served in the program. The $201 million in obligated funding represents 89 percent of the total available funds for the third year of the program. In fact, a front-page article in the October 25th issue of Education Week confirms this by stating:

| "With the idea of universal preschool slowly gaining more attention in the United States, one state (New York) has shown in a relatively short amount of time how to bring the public school system and providers of early-childhood education together to give more four-year olds educational opportunities." |

Full funding of $500 million for Universal Pre-kindergarten programs throughout the state will establish New York as the national leader in providing pre-kindergarten programs (see Figure 2) and ensure that all the children of New York State are well prepared for a 21st Century education.

Overall, LADDER's strong early education focus includes the Universal Pre-kindergarten program, reducing class sizes to twenty for grades K-3, and providing resources to move schools to full-day kindergarten programs. Research has consistently documented the benefits of pre-kindergarten and lower class size including increased achievement, higher graduation rates, lower dropout rates and reduction of disruptive behavior. These efforts have already proven enormously successful; during the 2000-01 school year roughly 52,000 four-year olds are enrolled in Universal Pre-kindergarten programs, approximately 1,100 new classrooms have been funded through the Class Size Reduction Program, and more than 14,000 additional kindergartners have been enrolled in full day-kindergarten programs as a result of the LADDER program (see Figure 3).

School Facilities

Another component of the LADDER plan is its efforts to improve the condition of school facilities across the state through formula changes which increase State support for construction. By successfully enacting a 10 percent increase in Building Aid reimbursement, a regional cost factor and by providing additional aid for minor maintenance and repair projects, the Assembly has taken the lead in directing the resources necessary to restore the condition of school facilities to a level which begins to support the hopes and dreams of the students of New York. The December 6, 2000 issue of Education Week reinforces this bold claim by stating; "Today, researchers appear to have reached considerable agreement on the question of whether the quality of school facilities boost student achievement. Most scholars who have studied the question concur, for example, that achievement suffers in rotten school environments."

The Assembly has continued to push for additional funds for school construction and this resulted in the enactment of the Assembly RESCUE plan. In School Year 1999-2000, RESCUE provided an additional $145 million in State support for critical school facility needs. This valuable program was expanded by $50 million in School Year 2000-01. Districts can apply for funding for critical capital projects and will be allowed to use these funds to offset the costs of improving the condition of school facilities.

Beyond simply providing additional resources for school facilities, RESCUE also includes the establishment of a comprehensive public school building safety program which requires the annual inspection, safety rating and monitoring system of all public school buildings used primarily for instruction. This serves as a mechanism to ensure that facilities are well maintained and well equipped to support the efforts of students as they prepare for the future.

However, even with the recent efforts of the Legislature to provide additional State support for school facilities, there remains an unmet need for capital expenditures. In addition, the new learning standards set by the Regents will require facility changes to correlate with instructional changes, including the need for modern science laboratories and air conditioned buildings so that additional summer instruction can occur. With many of the 4,000 school buildings in New York State being built prior to World War II, it is essential that the State continue to provide the resources necessary to improve the condition that students face in their school facilities on a daily basis.

An additional piece of the LADDER plan has been the directing of much needed resources for computer and technology needs, textbooks and computer software, staff development and extended day-school violence prevention programs.

The 2001-02 school year marks the final year of the four-year statutory phase-in of the Assembly LADDER plan. With this, the success of the efforts of the previous three years will be built upon through the continued expansion of the programs included within the LADDER plan. Present law provisions require an appropriation of $500 million in funding for Universal Pre-kindergarten, which will allow four-year olds the opportunity to attend pre-kindergarten programs; $225 million in funding for early grade class size reduction, which will provide for an estimated 1,500 additional classrooms; continued enhancements to building aid; an appropriation of $91 million for educational technology; funding of $35 million for professional development; an additional $50 million in funding for textbooks and software materials; and $50.2 million for extended day-school violence prevention programs. The Assembly remains committed to providing the full level of funding for LADDER programs as agreed to by the Governor and both houses of the Legislature during the 1997-98 State Budget negotiations. The cumulative effect of all of these LADDER initiatives work to support the attainment of the new Regents higher learning standards for all students. We will not accept the Governor's attempt to renege on these commitments.

The Challenge of Higher Standards

Following the lead of the Board of Regents, New York State has taken many steps to raise educational standards. New curriculum standards, high stakes examinations, and tougher graduation requirements are now demanding a lot more of our students, teachers, parents, and schools. But raising standards doesn't come without hard work and investment. We must ensure that all of our schoolchildren receive the support they need to meet the new standards.

There is no doubt that the standards movement in New York has made an impact. More students are taking and passing Regents examinations; the percentage of students passing has increased on all of these examinations. In fact, more students received a passing score on the Regents English examination in 1998-99 than had taken this examination in 1996-97. In addition, the percentage of graduates earning Regents diplomas has increased from 35 percent in 1989 to 45 percent in 1999.

But our work is just beginning. In the lower grades, especially the middle years, our children continue to perform at levels below their potential. On the 1999-2000 8th grade mathematics assessment, only 40 percent of eighth-graders met or exceeded the standards. On the 1999-2000 8th grade English and language arts assessment, only 45 percent met or exceeded the standards (see Figure 4). These numbers are impossible to ignore. New and more rigorous statewide tests are demonstrating a gap between current achievement levels and what is required under the new standards.

The Assembly will continue to fight for additional unrestricted aid for the support of raised academic standards. Recent increases in unrestricted aids such as Operating Aid, Extraordinary Needs Aid and Operating Standards Aid have given local districts the flexibility to target resources toward their particular needs. In fact, in 2000-01, total funding for unrestricted aids were the largest share of formula aids provided to school districts. The Assembly remains committed to providing adequate resources to support the educational needs of all children throughout New York State.

Recruiting and Retaining Quality Teachers

The issue of the quality of teaching has taken center stage in education discussions throughout the country. A growing body of evidence confirms what common sense has suggested all along: good teaching is a determining factor in how well students learn.

In our struggle to raise standards and improve student learning, there is little doubt that a focus on teacher quality must be central to any reform effort. However, New York State will be facing serious teacher shortages in the near future. In fact, 38 percent of New York's current teachers will retire or reach age 55 years and be eligible for full retirement benefits within the next five years. The baby-boom generation of teachers is reaching retirement age and the children of baby boomers are working their way through the school system, creating the need for additional teachers.

In addition to the supply problem, many recent policy changes such as those to raise learning standards, end social promotion, and reduce class size, increase the demand for additional high quality teachers. The problem of low supply and high demand for teachers exacerbates an already difficult teaching situation in urban schools where the teaching environment has been harsh for a long period of time. High teacher turnover and low median teacher salaries are apparent in these high need districts (see Figure 5).

To combat these shortages that loom on the horizon, we must increase State support for teacher programs. While the Executive proposal increases funding for the Teachers of Tomorrow program, it is bewildering that the Executive has once again attempted to cut by more than $98 million, existing recruitment, retention and education programs, including a significant reduction in Teacher Support Aid, and the elimination of Teacher Centers, the Teacher-Mentor-Intern Program, the National Standards Board Program and Instructional Staff Development. All these programs seek to establish a better trained professional workforce; elimination of these resources is simply shortsighted.

Without a vibrant, intelligent and motivated teaching force, we cannot create the educational system our children need. Therefore, the Assembly will continue to fight for State support for teacher recruitment, professional development and retention efforts.

Executive Budget Fails to Provide Leadership in Education

The Executive Budget for the 2001-02 school year leaves school districts without the resources they need to help their students meet the challenges of the future. The Executive proposes a decrease in State support for education of $1.129 billion when compared to present law. This is the result of cuts to General Support for Public Schools, the Assembly LADDER program, building aid and other educational programs as well.

Executive "Flex Aid" Proposal

The cornerstone of the Governor's proposal is the consolidation of 11 school aid categories into a single category -- Flex Aid. While this new aid category is increased by $250 million in the Executive proposal, this amount is $147 million less than the amount called for by current law for the consolidated aids (Operating Aid, Tax Equalization Aid, Tax Effort Aid, Limited English Proficiency, Gifted and Talented, Extraordinary Needs Aid, Educationally Related Support Services Aid, Public and Private Excess Cost Aid, Operating Standards Aid, and Minor Maintenance Aid). Nearly 70 percent of the Flex Aid increase of $250 million will be targeted to high-needs school districts including New York City; however the amount of the total increase is clearly insufficient.

Executive Building Aid Proposal

Beyond cuts in Flex Aid and LADDER, the Governor further reduces School Aid through other programs. One of the largest reductions is in the Building Aid category which prescribes a $314 million cut to present law. The Executive proposes numerous changes to Building Aid that drive this reduction including: priority-based selection and regional allocations, an assumed amortization schedule, ineligibility for aid for buildings that are not maintained, and aid ratios tied to when the project is approved. Considering the present conditions of school buildings in New York State, any reform to the Building Aid methodology will have to undergo strict evaluation to assure that school districts continue to have the resources necessary to tackle critical capital projects and ensure safe school facilities.

Localities have consistently been forced to shoulder an increasing burden of educational spending. The Education Department estimates the current level of State support to be 41.7 percent. In fact, a ranking of states by state support for education shows a decline from last year; New York State ranks well below the halfway mark, at 40th. (National Educational Association, Ranking of the States 2000) (see Figure 6)

We must provide every New York child equal access to every educational possibility, from early childhood to graduation. That means providing the time-proven benefits of pre-kindergarten and full-day kindergarten; reducing class size not only in grades K-3, but throughout all grades as well; building upon the Board of Regents ongoing efforts to raise standards by providing additional support for academic intervention services; and making certain that our school buildings are safe, modern, and technologically equipped.

School Aid Litigation

Litigation was commenced in May of 1993 in State Supreme Court challenging New York State's funding structure for New York City public schools. The lawsuit was filed on the grounds that the current system violated the Education Clause of the New York State Constitution, the Equal Protection Clause of the State and Federal Constitutions, and Title VI of the Civil Rights Act of 1964 and its implementing regulations.

On January 10, 2001, the Court rules in favor of the plaintiff on both the State Constitutional claim and the claim involving the implementing regulations of Title VI of the Civil Rights Act. The Court held that New York State has consistently violated the Education Article of the State Constitution by failing to provide the opportunity for a sound basic education to New York City's public school students. In addition, the Court found that the school financing system has an adverse unjustified disparate impact on minority public school students in violation of Federal Civil Rights regulations.

Although the Court did not prescribe a specific remedy, it stated that it is the responsibility of the State Legislature to take the necessary steps to reform the education system by September 15, 2001. The Governor has announced his decision to have the State appeal the Court ruling.

The 2001-02 Executive budget proposal continues to ignore the need to reinvest in Higher Education. Leaders from across the nation have embraced the concept that investing in a strong higher education system provides a crucial foundation for economic growth and the development of a highly trained workforce. Yet, while the nation was experiencing its greatest economic expansion in history the Executive proposed cumulative reductions in support of higher education totalling approximately $1.6 billion. The Assembly has stood firm in its commitment to working families from across the state and has fought to restore roughly $1.4 billion of these proposed reductions. Fighting against proposed reductions has limited the States ability to focus on expanding and improving existing programs. This year, the Assembly will continue to fight for working families and students seeking to expand their horizons through the pursuit of a higher education.

SUNY and CUNY

The Governor's proposal would provide a total of $1.8 billion in General Fund support for the four-year colleges of the State's two public university systems. This includes $1.2 billion in support of the general operating budget of the State-operated campuses of the State University of New York (SUNY) and $612 million in General Fund support for City University of New York (CUNY) senior colleges. Unfortunately, tuition and fee expenses have increased significantly in recent years at the two public university systems of the state.

The Governor's proposal also provides 324.6 million for SUNY operated community colleges and $128.6 million for CUNY community colleges. This reflects the continuation of the $125 per full time equivalent student base aid increase which was enacted in 2000-01. Unfortunately, the Governor fails to provide funding for other important improvements that were made in 2000-01 such as providing support for additional faculty and childcare services, and improved opportunities for economically disadvantaged students.

Tuition Assistance Program

The Governor also provides $636.4 million for the Tuition Assistance Program (TAP). This represents no change in state support for the program since 2000-01 resulting from improvements in the economy and income growth, which lowers average award levels. The Governor continues the enhancement to the program enacted in 2000-01 rather than make improvements to the program. The TAP program has been the target of proposed reductions throughout the term of Governor Pataki. This program is one of the most significant investments that New York State provides to students seeking access to a higher education. As the cost of receiving a higher education has steadily risen, the need for additional tuition assistance has never been more imperative.

SUNY Hospitals

The Executive proposal also includes a plan to restructure the fiscal relationship between the SUNY Health Science Centers (HSCs) and the State of New York. All hospital spending will be appropriated into a single account and the hospitals will be responsible for directly paying their fringe benefit and debt service costs. The Governor provides the HSCs with a direct state subsidy of $92 million to support their operations. This includes $40.7 million to reflect the continuation of the State's current subsidy level for the cost of fringe benefits. An additional $51.4 million is proposed in recognition of costs to the HSC's for State agency operations. In addition to proposing to change the fiscal relationship between the HSCs and the State, the Executive proposes to address the current $209 million shortfall in the SUNY operating budget that results from the HSC's inability to meet the $116 million assessment for the last two years. The Executive recommends a multi-year plan and authorizes the transfer of $15.2 million from available revenues of the Dormitory Authority of the State of New York as the State's initial payment to provide $84.6 million in State support. In addition, the Executive proposes HSCs contribute the remaining $124.4 million over a multi-year period. The State Financial Plan for 2001-02 assumes a payment of $11.2 million in 2001-02 as the HSCs efforts toward eliminating the shortfall.

Throughout the past six years, New York State has trailed the rest of the nation

in support for higher education (see Figure 7). In fact, over the last five-years

the cumulative increase in state appropriations for higher education has been

four percent, which ranks New York State 38th in the nation. (Chronicle of Higher

Education). In 1995, the average cost of tuition and fees for students attending

public four-year institutions in New York State was approximately $2,971. Since

1995 the average cost of tuition and fees has increase by approximately $934

or 31.44 percent to $3,905 (1995-96 and 2000-01 Almanac of Higher Education).

As a result, the average cost of tuition and fees for a student attending a

public four-year institution in New York State is roughly 17 percent greater

than the national average (2000-01 Almanac of Higher Education).

In 1999-2000, tuition and fee costs for attending a community college in New York State were over 56 percent higher than the national average. In a time when a significant investment is being directed toward large research institutions, the needs of the state's community colleges should not be ignored. Community colleges serve as a gateway to the pursuit of a higher education and train a significant portion of the workers needed in the new economy.

In order to reduce the burden on working families with students pursuing a college degree, the Assembly fought for historic increases to the Tuition Assistance Program (TAP) as part the 2000-01 enacted budget. As a result, the TAP Program increased by $21.4 million in 2000-01, marking the first year of a four-year phase-in of enhancements that will increase expenditures for the TAP program by $94 million by 2004-05. Included within this plan are the following provisions: increasing the maximum TAP award to $5,000 over a four year period beginning in 2000-01; raising the limitation on TAP awards to 95 percent of tuition expenses in the 2000-2001 and fully phasing out the award limitation in 2001-02. In addition, college juniors and seniors have received an additional increase of $50 in their TAP awards in the 2000-2001 academic year, and in 2001-02 juniors and seniors will receive an additional $100 increase in their TAP awards. Finally, the 2000-01 academic year began a three-year phase-in of an expansion of the minimum TAP award, this will increase the TAP award to $500 and raise income eligibility to $80,000.

In addition to expanding the TAP Program, a college tuition tax reduction was enacted which will provide $200 million in tax relief annually when fully implemented. Here, working families with a student pursuing a higher education will have the choice of deducting from their income 100 percent of qualified tuition expenses up to $10,000 or receiving a tax credit of the lesser of $200 or tuition paid. Finally, the Assembly fought for the restoration of support for opportunity programs for economically disadvantaged students at funding levels last achieved in 1994-95 and also additional support for additional faculty and childcare services at the State's public university systems. The Executive fails to maintain the Legislature's support for these programs.

The Assembly is committed to reinvesting in higher education and will continue

to fight to ensure that appropriate resources are provided to encourage economic

growth, ensure a quality education, and maintain access to a higher education

for New York's working families.

Medicaid

The Governor's State Fiscal Year 2001-02 cost containment package will result in the loss of more than $350 million in combined Federal, State, and local reimbursement to certain Medicaid providers. These new cuts are targeted primarily at nursing homes, but also impact certified home health care agencies and the pharmaceutical industry. These actions are certain to have a devastating impact on the quality of health care that is delivered by the State's long-term care facilities that are already struggling with pressing workforce issues and losses from previously enacted cuts. Approximately 15 percent of New Yorkers age 65 and older rely on Medicaid to cover their health care expenditures. As the elderly use a disproportionate share of nursing home and home health care services, New York's seniors are most at risk from these cuts. (see Figure 8)

The Health Care Reform Act of 2000: An Update

The enactment of the Health Care Reform Act of 2000 (HCRA 2000) created a number of new programs designed to provide health insurance coverage to many uninsured and underinsured New Yorkers.

HCRA 2000 established Family Health Plus (FHP), a comprehensive plan for subsidizing health insurance that will provide needed coverage for many of the uninsured parents of children now enrolled in the Child Health Plus (CHP) program. Although FHP was originally scheduled to begin on January 1, 2001, implementation is dependent on the State receiving necessary approvals from the Federal government. The Department of Health is moving forward in that process. Once the requisite Federal approvals are obtained from the Health Care Financing Administration (HCFA) the State will launch an advertising campaign to let people know that the program is beginning.

In addition, the HCRA 2000 created "Healthy New York," subsidized insurance for small businesses with 50 employees or less so they can provide their workers with basic health insurance. HCRA 2000 also subsidized premiums for workers whose employers do not provide insurance and those who are self-employed. Insurers will begin offering coverage for both programs on January 1, 2001. In total, the health insurance programs created in HCRA 2000 are expected to provide health insurance coverage for approximately one million New Yorkers.

Child Health Plus

In 1990, the Legislature established Child Health Plus (CHP), a program that provides health insurance to underinsured and uninsured children in New York State. In 1998, the Legislature expanded the Child Health Plus (CHP) program, greatly increasing the number of children eligible for health coverage in New York State. Additionally, the CHP expansion increased the number of services covered under the program; provided free coverage for children in families with incomes less than 160 percent of the Federal Poverty Level; lowered monthly premium contributions; eliminated family co-payments, and authorized the development of public education, outreach, and facilitated enrollment strategies. The legislation also raised the income eligibility levels for children receiving health care coverage under the Medicaid program.

Although New York State's Child Health Plus (CHP) program is one of the best in the nation, many children still face obstacles to enrollment and to retention of coverage. Moreover, the United Hospital Fund recently reported that more than 650,000 uninsured children appear to be eligible for either CHP or Medicaid, but are not enrolled in either program. The Child Health Plus program is due to expire on March 31, 2001. The Governor's budget proposal includes a simple extension of the current program until June 30, 2003. While continuation of this worthy program is assured, the Legislature will use this opportunity to address these and other concerns raised by the current program.

Managed Care

In his first budget six years ago, Governor Pataki proposed a plan to cut Medicaid costs while improving access to medical care for Medicaid recipients by enrolling such recipients, including the disabled, in managed care plans. His waiver application to the Federal government, entitled "The Partnership Plan," stated that by April 1997, 2.2 million Medicaid recipients would be enrolled in managed care. Nevertheless, even with Federal approval of mandatory Medicaid managed care in July 1997, enrollment has remained relatively flat. For the past few years, Medicaid managed care enrollees have hovered between 30 to 31 percent of eligible participants. In May 1999, New York State received Federal approval to begin mandatory enrollment of 1.5 million New York City Medicaid residents into managed care plans. The impact of this approval has yet to affect Medicaid managed care enrollment, which still constitutes 31 percent of total eligibles. As of November 1, 2000, Medicaid managed care enrollment was at 679,241 enrollees, up only four percent from November 1999. (see Figure 9)

Despite this lack of progress, the Executive continues to be optimistic about Medicaid managed care. His Executive Budget promises that by the end of SFY 2000-01, enrollments will rise to 796,000 and that 1.1 million Medicaid recipients will be enrolled in managed care by the end of SFY 2001-02.

Work and Wellness Act of 2000

Many persons with disabilities want to work but cannot take decent paying jobs without losing Medicaid coverage. Existing Medicaid income and resource limits prevent disabled individuals from earning enough to support themselves or their families. Persons with disabilities who are capable of working keep their earnings low in order to retain the Medicaid coverage they need to survive. The Federal Ticket to Work Incentives Improvement Act of 1999 provided states with the opportunity to implement Medicaid Buy-In programs with Federal Financial Participation (FFP).

In June 2000, the Assembly acted on the Federal statute and passed the Work and Wellness Act of 2000. However, the Senate and the Executive failed to take action.

Under the proposal passed by the Assembly in 2000, working individuals with disabilities would buy into the Medicaid program by paying premiums on a sliding fee scale based on income. Eligible individuals would include severely disabled workers with net available incomes up to 400 percent of the Federal Poverty Level, as well as workers with a severe impairment who cease to receive Supplemental Security Income (SSI) or Supplemental Security Disability Income (SSDI) benefits due to the improvement of their medical condition. The fiscal implications would not be significant, because many individuals who would participate are already in the Medicaid program. Moreover, the Assembly bill provided that the State would pay the entire non-federal share for program participants so there would be no new cost for local governments associated with the program. Additionally, the State would benefit from new State tax revenues and premiums paid by program participants.

The Governor's 2001-02 Executive budget recognizes the worthiness of the Medicaid Buy-In for the working disabled and recommends passage of a program. The Governor's proposal would provide eligibility to disabled working individuals whose income is up to 250 percent of the Federal Poverty Level (FPL), versus the 400 percent of FPL eligibility level proposed by the Assembly, effective January 1, 2002.

AIDS

AIDS is the fifth leading cause of death among Americans, aged 25 to 44, and the ninth leading cause of death among Americans, aged 15 to 24. In New York State, there are over 50,000 people living with AIDS and approximately 170,000 others living with symptomatic and asymptomatic HIV infection. At the same time, the rate of infection continues to grow, particularly among minorities, youth and women. Moreover, in recent years, there has been much medical advancement for individuals living with HIV/AIDS, in particular, the development of new drug therapies. While such advancements are helping these individuals live healthier, longer lives, they are also creating a greater demand for services.

Community-based organizations provide a wide variety of services to persons living with HIV/AIDS, including counseling, case management, legal counsel, medical respite, and home-delivered meals. Community-based services also provide programs that help HIV families plan for the future care of their children and offer support to children and adolescents who lose a parent or sibling to HIV. These programs have become a central component in New York's fight against HIV/AIDS.

Despite the escalating need for services, the Executive again this year fails to recommend increased funding for AIDS programs. In fact, the Executive proposes to eliminate over $7 million in legislative enhancements that were included in the SFY 2000-01 enacted budget.

In previous years and again this year, the New York State AIDS Advisory Council

recommends that funding be restored for a variety of programs that are not included

in the Governor's proposed budget for SFY 2001-02. The Council also recommends

additional funding for AIDS-related programs to increase education, outreach

and support services.

Currently, approximately three million persons who are 60 years of age or older reside in New York State. This number is expected to increase dramatically in future years as the "baby-boom" population, which comprises 24 percent of the State's total population, reaches 60 years of age.

Despite this growing population, the Executive fails to recommend substantive increases to senior programs. In fact, the Executive proposes to eliminate approximately $6 million in legislative initiatives and enhancements that were included in the SFY 2000-01 enacted budget.

Community-based services for the elderly help older New Yorkers to be as independent as possible, for as long as possible, thereby avoiding costly institutional care. In a recent report published by the State Office for the Aging (SOFA), entitled Project 2015: The Future of Aging in New York State, findings indicate that as the "baby-boom" population reaches 65 years, "good nutrition will play a significant role in affecting chronic health conditions and illness." The report also indicates that practicing healthy nutrition habits now would decrease the likelihood of utilizing more costly services in the future, like long-term institutional care. In order to guarantee good health among our aging population, the report recommends taking steps to "ensure that people in the greatest need are identified and served and to improve outreach and expand programs to reach more older people who are food insecure and homebound." Despite these suggestions from the Governor's State Office for the Aging, the Governor fails to recommend increased funding for community-based services, like the Supplemental Nutrition Assistance Program (SNAP) and the Expanded In-Home Services for the Elderly Program (EISEP), which provide such services.

Elderly Pharmaceutical Insurance Coverage (EPIC) program

In the enacted State Fiscal Year (SFY) 2000-01 budget, the Legislature significantly enhanced the Elderly Pharmaceutical Insurance Coverage (EPIC) program. The EPIC expansion, which became effective January 1, 2001, increased income eligibility to $35,000 for singles and $50,000 for married couples. In addition, the EPIC expansion reduced annual fees and co-payments by 20 percent and reduced co-pay thresholds by five percent. The EPIC expansion also reduced the number of co-payments from five to four. Additionally, the EPIC expansion simplified the program structure by limiting the fee plan to incomes up to $20,000 for singles and $26,000 for married couples and by providing that eligible persons with incomes over these amounts will be in the deductible plan.

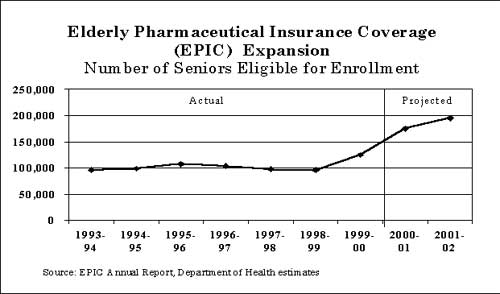

Currently, approximately 130,000 seniors are enrolled in the EPIC program. The Executive anticipates the EPIC expansion will increase enrollment to over 215,000 seniors by the year 2003. (see Figure 10)

Figure 10

Figure 10The Executive's forecast for the national economy is generally in line with those of other forecasters. The Executive estimates that economic growth for 2000, as measured by growth in real gross domestic product (GDP), will reach 5.1 percent. For 2001, the Executive projects a slower growth rate of 2.7 percent. This forecast for 2001 is just 0.1 percentage points above the Blue Chip Economic Consensus, which is a compendium of the forecasts of 50 private sector forecasters.

The Executive is forecasting a decrease in the rate of consumer price inflation from 3.3 percent in 2000 to 2.7 percent in 2001. This is primarily due to the unwinding of most of the increase in the core inflation rate experienced in 2000 which had increased the prices of energy and energy-related products. National employment growth is expected to slow to 1.1 percent in 2001 from 2.1 percent in 2000. Growth in both personal income and its largest component, wages and salaries, is projected by the Executive to decline from 6.3 percent and 6.5 percent, respectively, to 5.0 percent and 5.5 percent in 2001. U.S. corporate profit growth is projected to decline from 14.2 percent in 2000 to 3.4 percent in 2001.

The Executive projects a slowdown in State employment growth for 2001 from 2.1 percent for 2000 to 1.4 percent for 2001. Growth in the non-bonus component of wages and salaries is also expected to decline from 7.7 percent in 2000 to 5.4 percent in 2001. However, growth in the bonus component of wages is expected to drop from 19.4 percent in 2000 to 2.4 percent in 2001. Combining these two components produces growth in overall State wages and salaries of 9.1 percent in 2000, followed by lower growth of 5.0 percent for 2001. Similarly, overall personal income growth will drop from 7.8 percent in 2000 to 4.6 percent in 2001.

The Executive states the New York economy has strengthened relative not only to its own recent performance, but also to the rest of the nation. However, although New York State employment growth outpaced U.S. employment growth in 1999, State employment has grown at only about two-thirds of the national rate since 1995. Indeed, had New York kept pace with the nation since 1995, the State would now have an additional 384,200 jobs, for a total of over one million new jobs (see Figure 11). Had New York grown as fast as Florida, Texas, or California, we would have generated much more than one million new jobs (roughly 1.8 million, 1.7 million, and 1.5 million, respectively).

Even now, New York is doing better than 30 other states of the union (see Table 2). On the basis of total employment growth for 2000, New York ranks 19th among the 50 states and the District of Columbia. In contrast to New York, all of the nation's other large states rank among the top ten. Florida's 4.2 percent rate of growth makes it the third fastest growing state in the nation. California ranks sixth at 3.2 percent, while Texas ranks eighth at 2.7 percent.

However, employment growth within the State is uneven. For example, if Downstate were a separate State, it would have ranked 15th in the employment growth while Upstate would have ranked only 33rd. Downstate ranks in the top third, while Upstate ranks in the bottom third.

While the economy may appear to some to be much stronger than it was in the 1980s, it is not obvious in all areas of the state. For example, in Western New York, the 1980s economic expansion employment growth was much stronger than it has been in the current expansion that started in the 1990s. Furthermore, the gap in employment growth between Western New York and the nation has widened.

Clearly, the Executive's economic development policies have failed to capitalize on the longest economic expansion in history. Upstate manufacturing employment has fallen consistently since July 1998 following a short period of growth immediately prior. Upstate employment growth of 1.2 percent fell a full percentage point below the downstate growth of 2.2 percent in the first half of 2000.

The lag in upstate growth is further illustrated when looking at regional employment growth. The Western New York region saw virtually no growth in 1998 and recent employment data suggests that while the upstate economy shows signs of improvement, it continues to lag behind downstate and statewide figures. Employment in the Western New York region, which includes Erie and Niagara Counties, grew by only .4 percent in the first half of 2000 compared to 1.2 percent for upstate, and 2.0 percent statewide. If Western New York data is excluded, the upstate region shows growth of only 1.3 percent during the half of 2000. The Finger Lakes region, including Monroe County, experienced a growth rate of only 1.4 percent and the Central New York region, including Onondaga County, saw a growth rate of only 1.6 percent. Both trailed the remaining upstate regions and lagged behind the state average in employment growth.

While employment growth in New York City has been strong the last several years; the rate of growth has been disparate across the five boroughs. For the first half of 2000, the employment growth rate in Manhattan was at least twice the employment growth rate for the Bronx, Richmond and Queens Counties.

It is clear that New York's economic success depends on a change in policy direction. New York State needs an economic development policy that ensures a timely and efficient delivery of services and targets resources on a regional basis. The Executive's top-down, project-by-project delivery of State economic development dollars restricts New York's economy from reaching its potential.

New York State has ignored the needs of manufacturers and needs to make a substantial investment in this critical sector. While the State has promoted economic growth and encouraged collaboration with the State's institutions of higher education through the Jobs 2000 for New York State Act, implementation of the Act has been slow. Access to capital for small businesses continues to be a problem at a time when small business workers make up fifty-three percent of the State's workforce (NYS Department of Labor). Finally, the Strategic Training Alliance Program needs to be implemented and streamlined. The program has been in place for two years and the Administration has failed to implement it at a time when businesses are in need of a highly skilled workforce.

The Assembly is encouraged by the Executive's economic development proposal for expansion of the Empire Zones, a $1 billion high-technology and biotechnology program and the proposal to address the needs of upstate's manufacturers. However, without a change in the structure and administration of the State's economic development programs, New York will not fully realize the State's great potential.

Restructuring ESDC/Promoting Regional Growth

The current Administration's approach to economic development diminishes the overall impact of State economic assistance. The current structure of the Empire State Development Corporation does not support regional needs and makes no consideration for regional economic development plans. In the face of the rapidly changing economy and high levels of competition from other states and other nations, New York needs to adopt a more effective organization for the creation and implementation of its economic goals. Other states including New Jersey, Florida, Michigan and Virginia currently utilize public-private boards to provide the governance for their overall economic development.

The Assembly encourages the creation of a new, non-partisan, locally driven organization governed by a board that represents the diversity of the State's economic and geographic needs. This new structure would provide increased coordination and flexibility of New York State's economic development programs while being more market-driven, responsive, and accountable than the current system.

Expanding the role of Higher Education in Economic Development

The 1999-2000 JOBS 2000 for New York State provided more than $117 million in State Funds for research and development, capital improvements at research universities, incentive grants for Centers for Advanced Technology and incentives to attract quality research and development faculty. The Executive proposal provides $283 million in State funding over the next five years with the goal of leveraging $700 million in Federal, university and private funds. The proposed plan assumes support for high-technology "Centers of Excellence" in Albany, Rochester, Buffalo and other areas in the State.

The Assembly is encouraged by the Executives support for high-technology efforts. A successful high-technology agenda should provide for the support of all emerging technologies including biomedical research, life sciences, genomics, photonics, communications and other converging industries through collaboration between industry and the State's institutions of higher education. Statutory language is needed to ensure that the greatest economic potential is realized from this investment.

To further expand the role of higher education in research and development and job creation, New York must also build on existing, successful high technology initiatives like the Centers for Advanced Technology and the Technology Transfer program. These programs must receive increased funding to realize their full potential.

Investing in Workforce Development

In a recent survey of its members conducted by the Business Council of New York, Inc., employers remain very concerned about the shortage of skilled workers. This finding applied to both small and large companies (Compensation Data-New York 1999, August 1999). As technology continues to drive changes in almost every industry sector and as new, emerging industries gain significance in the state's overall economy, the demand for a workforce that is technically skilled will grow. The National Science Foundation in its report, The Supply of Information Technology Workers in the United States, finds that this is especially true in the information technology industry. Jobs associated with this industry are distributed throughout virtually every sector of the State's economy and are among New York's fastest growing occupations.

An earlier Business Council report had concluded that almost 70 percent of business respondents acknowledged that productivity in their companies had suffered because of employee skill gaps (Public Policy Forum, May 1998). This "skills gap" - the mismatch between skills of the labor force and those required in jobs created by today's economy - is a barrier to job creation and economic expansion. Almost all employers stated that their existing workforce needed to obtain skills upgrading in one or more areas - with technology skills ranked first, at 84.5 percent.

The Governor continues the existing Strategic Training Alliance Program. This job training program, which provides for the development of a technologically skilled workforce, was enacted in 1998 and funded at over $28 million in 1999. The program is designed to address the skills shortage needs. However, to date, the Department of Labor and the Urban Development Corporation have only approved $382,000 for eight training projects while at least 89 companies and training providers have submitted requests for funding. While the Assembly supports workforce retraining and employee skills upgrading the inability of the Executive agencies to implement this program, at a time when there is such a great demand for a trained workforce, further demonstrates the need for a change in the administration of economic development policy in New York State.

Empire Zones

Last year, the Assembly Majority successfully fought to include the Empire Zones Program as part of the enacted State Budget. There are currently 52 Zones statewide in which businesses that create new jobs do business essentially "tax free". In addition, six new zones are slated for designation in March 2001.

The Executive proposes to double the size of Empire Zones in 22 upstate communities from the current two square miles to four square miles. Eligible Zones were selected based on criteria includes population change, per capita income and unemployment rates.

Revitalizing New York's Manufacturing Sector

The Executive seeks to address issues raised by the manufacturing industry by proposing to eliminate the Alternative Minimum Tax, enacting a single sales factor for manufacturers, and providing support for workforce retraining. However, other incentives and technical assistance must be given to manufacturers to assist them in transforming their core manufacturing processes through the introduction of new technologies. Any sound economic development plan to revitalize New York's manufacturing sector, must include the fostering of partnerships among the education, research and business community.

Providing Capital Access to Small Businesses

Many small business start-ups continue to find it difficult to access much needed financing, especially venture capital. Minority-and-women-owned businesses are even more susceptible to failure due to their inability to access financing. Data collected from the State Department of Labor indicates that as of June of 2000, small businesses made up 89 percent of the firms in New York and employed over 53 percent of the State's workforce, an increase of nine percent from 1998 (NYS Department of Labor). With these statistics in mind, a concerted effort must be made to address the capital needs of New York's small businesses.

The Executive Budget does not address the capital needs of small businesses, the job creation engine in New York State. The Assembly Majority continues to put the interests of small businesses high on its priority list. Originally an Assembly initiative, the Excelsior Linked Deposit Program provides small businesses with access to capital through "linked" loans. This year, the Assembly will work with the Comptroller to ensure maximum State Public Authority participation in this program.

Under the CAPCO program, an Assembly initiative, insurance companies that invest in small start-up companies are given a credit for their investments, thus encouraging investment in small businesses. To date the Assembly has allocated $280 million to the CAPCO program, for which investment credit may be claimed. The Assembly supports the CAPCO program and finds it necessary in providing financing to small businesses. The Assembly also supported the New York State Venture Capital Program. Under this program, the Comptroller is authorized to make investments in partnerships, trusts, and limited liability companies that agree to invest in qualified businesses in the State.

New York State has great economic strengths and even greater potential. The

State is home to premier research universities, strong liberal arts colleges,

and community colleges that are the engines for economic growth and are poised

to meet the workforce needs of the new economy. Yet the current system of economic

delivery has not fully provided all of New York's regions with their share of

economic benefits. Restructuring the administration of economic development

to promote regional growth, expand collaboration of higher education and industry,

invest in workforce development and provide small businesses access to capital

to encourage job creation represents the strategic effort New York needs to

revitalize all of the State's communities.

The Executive has failed to demonstrate leadership in the area of energy policy in New York State. Given concerns about job creation and retention, particularly in Upstate New York, the need for a comprehensive energy policy that encourages economic growth and provides rate relief for businesses and residents of this State cannot continue to be ignored. New York State's utility rates are currently the third highest in the entire nation.

The Executive Budget includes actions that further display the Executive's lack of concern for the rising cost of energy prices. The Governor's SFY 2001-02 Budget includes proposals that in fact will further exacerbate the existing problems. In the wake of continued rate hikes, the Executive proposes to eliminate the Utility Intervention Unit at the Consumer Protection Board that serves to intervene as advocates on behalf of residents and small business owners before the Public Service Commission (PSC) rate setting hearings. While the Executive claims that this service could be provided by the PSC's regulatory unit, 13 positions in the PSC are also proposed for elimination in the Executive Budget.

The Assembly will continue to advocate for actions that will provide immediate rate relief for all energy customers, and provide mechanisms to guarantee market development that offers true customer choice. Further the Assembly majority supports the establishment of a program that encourages energy efficiency initiatives and encourages innovative generation technologies.

The Executive must show some leadership in the energy arena this year. Without

a policy, the State will continue to experience rising prices and the Upstate

economy will never reach its economic proposal.

The Capital Program of the Department of Transportation, along with a number

of local road and bridge programs, are supported by New York's Dedicated Highway

and Bridge Trust Fund. This fund is comprised of revenues from motor fuel taxes,

motor vehicle registration fees, and highway user fees.

The Capital Program of the Department of Transportation is a five-year program

that will improve and rehabilitate critical components of the State's transportation

infrastructure, by providing funds for State and local roads and bridges, transit

systems, the State's freight and passenger rail network, airports, ports, economic

investments through the Industrial Access Program, and canals. This transportation

capital program helps to improve the transportation infrastructure, increases

the flow of goods and services, spur economic development and job creation,

and assists the state to compete in the 21st century global economy.

In State Fiscal Year (SFY) 2000-01, a $17.1 billion five-year Transportation Capital Program that included a $3.8 billion Transportation Bond Act was presented for voter approval on the statewide ballot on November 2000. The Transportation Bond Act of 2000 would have secured funds for the State and local highway and bridges, aviation, rail, transit systems, and ports and canals. This bond act narrowly failed to gain the necessary voter support and resulted in a need for the Executive to present a new five-year plan to account for the Transportation Bond Act shortfall. The Executive proposed five-year plan is much lower than the plan proposed in SFY 2000-01.

The Executive has proposed a new five-year plan for State and local highways, roads, bridges, aviation and rail. This plan totals approximately $15.5 billion, $8.6 billion for the State Highway and Bridge Capital Program; $3.2 billion for engineering design, inspection and planning; $1.29 billion for local capital programs, including CHIPs and Marchiselli; $125 million for Industrial Access Program; $80 million for Rail Freight and Passenger program and $38 million for the Aviation program.

Mass Transit

The Metropolitan Transportation Authority Capital program, approved by the Capital Program Review Board in May of 2000, continued to rehabilitate and modernize the bus, subway and commuter rail systems; support transit service enhancements including the conversion to clean fuel buses; and design and construct several major projects to expand the transit system. The Metropolitan Transportation Authority (MTA) approved and submitted a Capital Plan for 2000-04 of $17.1 billion to the Capital Program Review Board (CPRB), which is comprised of representatives of the Executive, the Senate, the Assembly and the Mayor of New York City. The Board approved the Capital Plan ($17.1 billion) excluding areas relating to Bridges and Tunnels ($1 billion).

The $17.1 billion five-year MTA Capital Program included $1.6 billion of the $3.8 billion Transportation Bond Act that was presented for voter approval on the statewide ballot on November 2000. The Transportation Bond Act of 2000 would have secured funds for the MTA to improve and expand the transit system and enhancements including the conversion to clean fuel buses. This bond act narrowly failed to gain the necessary voter support and resulted in a need for the MTA to revise the five-year capital plan to account for the Transportation Bond Act shortfall. At the time of the submission of the Executive budget, no new plan had yet been submitted.

The MTA Capital Plan for 2000-04 is 36 percent more than the previous plan. Capital investments by the MTA are of the following: $10.3 billion for New York City subways and buses; $2.1 billion for Long Island Rail Road; $1.3 million for Metro-North Railroad; $3.3 billion for expansion on new initiatives; and $1 billion for bridges and tunnels.

The large increase in the Capital Plan can be attributable to the MTA's undertaking of new initiatives for system expansion ($3.3 billion). These new initiatives would be: $1.5 billion for the East Side Access linking Long Island Rail Road to Grand Central Terminal; $1.05 billion for the environmental work, final design and begin elementary tunnel work for a full length Second Avenue Subway; $68 million for planning, design and engineering of the #7 Line extension to Javits Center, Lower Manhattan Access, and Metro North Penn Station Access; $645 million for LaGuardia Airport Access.

A Clean Fuel Program was included in the MTA Capital Plan for $250 million. The Clean Fuel Program consisted of bus purchases by the MTA. New York City Transit is scheduled to purchase 1,257 new buses. The new buses are comprised of 300 compressed natural gas buses, 250 hybrid electric powered buses, 447 over-the-road express buses with CRT "particulate traps", and all remain diesel buses will be retrofitted with CRT "particulate traps"; perform station and shop rehabilitation or maintenance; and modernize or upgrade communication systems.

The Capital Plan provided for the New York City Transit to purchase 1,130 new

subway cars. The Long Island Rail Road would purchase 472 new cars, renovate

stations, replace line structures, and modernize some of its trains with new

technology such as the Communication Based Train Control System. The Metro-North

Railroad would purchase 180 new cars and locomotives, and perform station, track

and shop improvements. Major bridge repair and replacement work is planned for

the Triborough and Bronx-Whitestone bridges, and rehabilitation work is planned

on the Brooklyn-Battery tunnel. There are plans to implement a new Intelligent

Transportation System at toll plazas.

Actual revenue from all MTA's transit systems are financially performing better

than the Operating Budget planned. An increase in the MTA's revenue performance

can be attributed in part to an increase in passenger ridership. As of October

2000, the total MTA passenger ridership year-to-date is 7.09 percent higher

than the previous year. Passenger ridership can be extremely helpful to improve

the Operating Budget of the MTA.

The Department of Labor is the lead agency for workforce development in the State. It has administrative responsibility for the Federal Workforce Investment Act, employment programs for public assistance recipients, the unemployment insurance program, the occupational health and safety program, and the labor standards program. State and Federal programs administered by the agency provide employment and job training services to currently employed individuals, unemployed individuals, dislocated workers, and public assistance recipients.

The Workforce Investment Act (WIA), the successor to the Job Training Partnership Act (JTPA), requires that states establish a system of "one-stop" employment centers that will provide a broad range of services in each workforce investment area. The centers are designed to serve any individual looking for employment related services and to assist employers who need to identify skilled workers. Although many "one-stop" sites are now operating throughout the state, there are still concerns that services to individuals may be disrupted through the transition from JTPA to WIA. New York City, for example, has only one operational center even though one in each borough has been planned.

Most individuals leaving public assistance for employment are at the lowest income levels in the workforce. Assistance that would help them retain unsubsidized employment such as additional job training, skills upgrades and tuition assistance is available under the Federal Welfare-to-Work Block Grant. The Executive has not made effective use of these kinds of job retention services, leaving nearly $250 million in Federal Funds dedicated for these purposes unspent. Minor changes in the economy could have a significant affect on these marginally employed individuals forcing them to return to public assistance.

Workforce Development

Continued growth in the State's economy will depend in part on the increased productivity of its workforce and skills development of that workforce is critical to the process. There has been an increased commitment by employers to training, necessary in part because of the shrinking pool of available labor and the skills gap which has led to a shortage of skilled workers in key industries. That employer commitment extends to small businesses as well as large firms; firms with fewer than 500 employees report that they will increase training expenditures by over 19 percent from current levels. Larger companies (2000 employees and over) expect to increase spending on training by over 8 percent.

Like these businesses, the Assembly has long recognized the importance of strengthening

the State's economy by improving the skills of the New York workforce. Economic

growth is dependent on a comprehensive plan that must include commitments of

assistance from the State to both workers and employers for skills development

efforts. However the Executive has not put forward a strong proposal to close

the gap between the skills of working New Yorkers and those skills required

in a technology driven economy. Funding provided for skills training appropriated

by the Legislature has not been expended and, in some cases, program spending

has been reduced.

The availability of reliable child care gives parents the opportunity to look for and to retain work. However, access to child care is both a major concern and expense for working families. The enacted budget for State Fiscal Year (SFY) 2000-2001 provided a record-breaking adjusted gross total of $808 million for the State's Child Care Block Grant to support child care subsidies, programs, services and worker retention. This funding supports 174,000 subsidized child care slots for low-income families, an increase of 30,000 subsidized placements from SFY 1999-2000.

Equally as important as child care that is affordable and accessible, is the safety and quality of such child care and a reasonable expectation that such care will serve to enhance a child's cognitive and social development. The Governor and the Legislature acknowledged this concern in the current fiscal year with the enactment of the Quality Child Care and Protection Act (Chapter 416 of the Laws of 2000). The success of this new initiative depends, in large part, on a workforce that is adequate in size and possesses the requisite professional expertise.

In SFY 2000-2001, the Assembly initiated the discussion regarding the enhanced recruitment, retention and professional development of a qualified child care workforce. In response to issues of low, non-competitive wages for child care providers, as well as the inability to recruit and to retain qualified teaching and supervisory staff, the Assembly secured $40 million for a new Child Care Professional Retention Program. So far, the Office of Children and Family Services (OCFS) has received 11,000 applications to this program and has issued a Request for Proposals for an "application processing and verification contractor" to administer the distribution of funds.

For SFY 2001-02 the Governor recommends $840 million for the Child Care Block Grant, a net increase of $32 million in Federal funding to sustain the current 174,000 subsidies and to provide for increases in the child care market rate. Regrettably, the $40 million included in the SFY 2000-01 to support child care worker retention is not continued by the Governor.

The shortage of vacant child care slots is yet another obstacle to working

families. The demand far exceeds the supply and this has created a pressing

need to develop additional child care capacity. In SFY 2000-01, the Assembly

secured $15 million in second year funding for the Child Care Facilities Development

Program, bringing the cumulative appropriation total for this program to $30

million. To date, 34 grants totaling $20.5 million have been awarded statewide,

which will create approximately 4,000 new child care slots for working families.

While the Executive pledges to continue the implementation of the existing child

care capital program, the budget submission for SFY 2001-02 fails to provide

new funding for the development of additional child care slots.

Despite the State's accomplishments, the Governor and the Legislature must continue

to work together towards increasing the number of subsidized child care slots,

improving the quality of the child care workforce and developing additional

child care capacity.

Child Welfare Financing

The Family and Children's Services Block Grant was established in SFY 1995-96

to consolidate State reimbursement for child welfare services. This new funding

methodology was created to allow counties greater flexibility in the delivery

of preventive, protective, adoption and foster care services. From the beginning,

this Block Grant was criticized for being inadequately funded and accused of

being a systemic deterrent to the provision of proper social work. Inadequate

funding of the Block Grant has also been blamed for a decrease in the workforce

with turnover reaching as high as 50 percent in some agencies due to increasingly

non-competitive salaries. Specifically, government employees can earn as much

as $38,134 while case workers at most voluntary agencies earn as little as $17,740

(Times Union, OP ED, January 14, 2001).

In SFY 1999-2000, the Legislature extended the Block Grant until March 31, 2001.

At the same time, it required the Office of Children and Family Services (OCFS)

to evaluate the existing system of child welfare financing and service delivery

and to submit a proposal regarding the future funding of child welfare services

after that date by June 30, 2000.

The Governor supports the proposal put forth by OCFS in June in his 2001-02 Executive budget. Not only does he recommend a total revamping of the State's child welfare financing system, but he also proposes a total of $631.5 million in child welfare spending, an increase of $28 million, over the current fiscal year.

As the Legislature reviews this proposal, the efficacy of current policies that complicate efforts to deliver services properly will be a vital part of the decision. The debate must also include discussions about caseworker compensation and staff ratios, as well as OCFS' continued role as the agency responsible for the promotion of the health, safety and development of children who ultimately wind up in the custody of the State.

Children's Mental Health Services

At present, the availability of quality mental health care services for families in crisis is severely limited. Such services can help families address problems that, left untreated, often escalate into devastating community problems. Likewise, accessibility to mental health services is critical to the resolution of problems that jeopardize the preservation of families and the reunification of children with their families. It is generally agreed that the inadequacy of these services throughout the State has risen to crisis proportion. Consequently, this systemic failure ultimately results in drug and alcohol use and abuse, violence, school failure and juvenile crime.

The number of children with mental health service needs in the custody of OCFS' Division of Rehabilitative Services has increased by eighty-one percent since 1995. Of the 3,897 youth currently in OCFS custody, fifty-four percent are in need of mental health services. Additionally, 2,320 youth or seventy-four percent have been assessed, at intake, with substance abuse service needs

While they are in the State's custody, youth receive very limited mental health services. According to recent OCFS data, 47 percent of the youth discharged from its care continue to have mental health service needs. In general, however, no plan for aftercare services for these youth is in place to assure that their mental health needs will be met in the community.

In SFY 2000-2001, the Governor failed to address this crisis adequately. Although the Governor provided for a $125 million mental health package for children and families, only a mere one percent of that funding, $1.6 million, is earmarked for OCFS. This funding will be used to replicate the mental health model which currently operates at Highland Secure Center in five other agency-operated facilities. As the current fiscal year ends, not one of the five new units has opened. Moreover, this new initiative includes no funding for aftercare services for these children once they leave the facility.

In SFY 2000-2001, the Assembly secured $1 million for a pilot aftercare program for youth discharged from OCFS-operated residential facilities and an additional $23 million for preventive services, to support partnerships that focus on intensive case management for children and families affected by substance abuse. Funds for these programs have yet to be awarded, however.

Faced with the opportunity to improve its child welfare system, New York State

must enhance its commitment to the provision of support services that preserve

the family, reduce the need for out of home placements and divert juveniles

from the court system.

The balance between inpatient versus outpatient treatment and State-operated versus community-based provision of services is a delicate one in the mental health system. The Executive's two-year plan to consolidate certain State-operated children's and adult psychiatric centers and close certain adult psychiatric facilities highlights the need to re-evaluate this balance to ensure that State operated mental health services continue to be available to those individuals who need them while at the same time providing sufficient funding for community-based services.

Community Services

March 31, 2001 ends year one of a two-year expansion of State and local mental health services. When fully funded in State Fiscal Year (SFY) 2001-02, the Enhanced Community Services Program will increase support for mental health services by $125 million in Federal, State and local funds. Of that total, the State's share will be $86.4 million, with $19.6 million for State operations and $66.8 million Aid to Localities.

The $56.5 million in State Operations and Aid to Localities Funds, appropriated in SFY 2000-01, has barely begun to flow. The State Operations share totals $15.9 million, including $1.25 million for a joint Office of Mental Health (OMH) and Office of Children and Family Services' (OCFS) program. A significant number of children in OCFS facilities are seriously emotionally disturbed. Yet, there has only been one mental health team to serve children in 32 facilities. Five additional mental health teams are provided for in the services expansion, but although the SFY 2000-01 budget was passed nearly eight months ago, the sorely needed mental health teams are still not operational. The Executive committed itself to spending the remaining $40.6 million on significant expansion of the community-based mental health services system that serves both children and adults. As of November 30, 2000, only $1.7 million of the promised funding had been disbursed, although the Executive expects that much of the funding will flow during the last two months of the fiscal year. Meanwhile, mentally ill children and adults continue to wait.

Children's Services

Federal prevalence studies indicate that there are as many as 158,000 children and youth with serious emotional disorders in New York State. Although the Governor's Enhanced Community Services Program provides for children's case management slots, home and community based services waiver openings, family based treatment placements and family support services opportunities, the community services available will still fall far short of need, given the magnitude of the problem, even when the program is fully funded. The Governor's proposed ten percent increase to Medicaid clinic fees provides some welcome relief to service providers. However, the cap on funding for outpatient Medicaid services, the so-called Medicaid Neutrality Cap, remains a significant barrier to necessary future outpatient service expansion. Service providers and advocates for children and youth with serious emotional disorders state clearly that extremely vulnerable children are not receiving the services they desperately need because of the Executive imposed cap on funding.

The cap has a negative impact on children not covered by the Home and Community Based Services Waiver but rely on outpatient mental health services. The Waiver provides opportunities for children and youth, who otherwise would require hospitalization, to be treated in their communities rather than in more restrictive and costly institutions. For those children waiver services are an excellent and appropriate alternative. Nevertheless, some children do require inpatient care and there are still more than 200 children and youth on community waiting lists for placement in Residential Treatment Facilities (RTFs). Although the Governor has added 19 emergency RTF beds, a class action lawsuit is pending that would require children and youth with serious emotional disorders to be placed in a residential treatment facility within 30 days of referral.